This content has been automatically translated and may include minor variations.

When banks, credit unions, and insurance providers go through mergers or acquisitions, the result can be operational alignment — but brand confusion. Multiple branches, legacy systems, outdated assets, conflicting messaging, and strict governance standards all create challenges.

Consistency isn’t just a marketing priority in finance – it’s a compliance necessity. This blog explores how to overcome that challenge with the right content governance tools. Discover how Digital Asset Management (DAM) and Templated Content Creation can help teams stay compliant, consistent, and in control at every branch, during every change.

How to maintain brand consistency during mergers in financial services

In the financial world, mergers and acquisitions are a given. Institutions consolidate to scale services, expand into new regions, or unify under a stronger umbrella brand. But without centralized governance, local branches often:

- Use outdated or incorrect logos, templates, or disclaimers

- Depend on head office or agencies for every content request

- Operate in silos, leading to conflicting messages and compliance risk

All of this puts the brand’s trust, credibility, and regulatory standing at risk.

Why brand compliance is critical for financial content creation

According to the Content Marketing Institute’s Financial Services Survey (2024), 63% of financial marketers cite regulatory compliance as their number one content creation challenge.

63%

of financial marketers list compliance as top challenge

Source: Content Marketing Institute

63%

of financial marketers list compliance as top challenge

Source: Content Marketing Institute

Trust is the currency of financial services. That trust starts with clarity and consistency — across brochures, branches, campaigns, and digital channels. But staying on-brand at scale is difficult when teams:

- Work across dozens or hundreds of branches

- Manage content in siloed systems

- Lack access to approved, compliant materials

When speed matters — reacting to market shifts or regulatory changes — long approval chains or outdated folders won’t cut it.

How a DAM creates brand integrity in every financial services branch

Forrester’s DAM Trends Report (2024) shows that more than 60% of financial services firms have adopted a Digital Asset Management solution in the past three years. [Source: Forrester, 2024].

Papirfly’s DAM and Templated Content Creation solutions are purpose-built to solve these challenges. Our suite creates a single hub for everything your teams need to stay on-brand and compliant — even during large-scale changes like mergers and acquisitions.

- Centralized brand hub – Distribute updated assets, disclaimers, and messaging in one secure, searchable brand portal

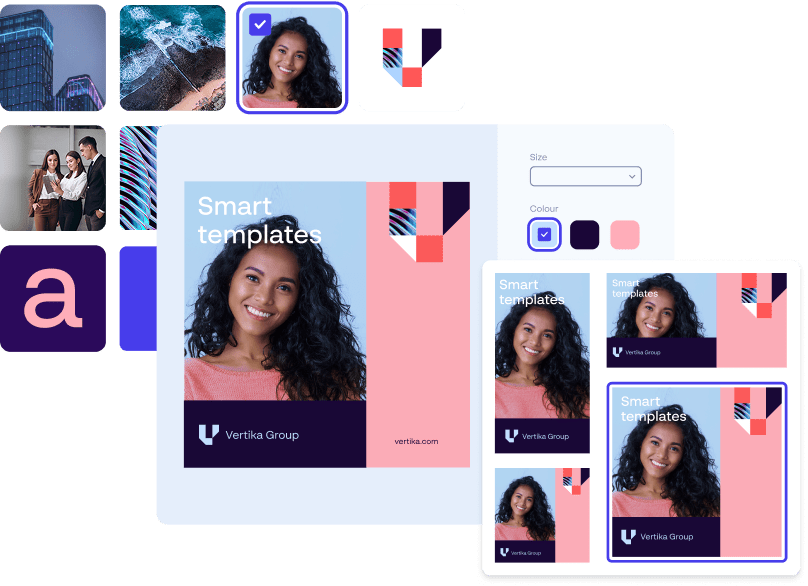

- Smart templates – Empower branches to localize content while protecting layout, logos, and legal copy

- Approval workflows – Streamline compliance reviews and guarantee brand alignment before go-live

- Audit-ready control – Maintain a full record of how assets are created, edited, and used

Regulated industries need marketing tools built for compliance

Papirfly already supports financial organizations worldwide — including Deutsche Bank, Citi, Goldman Sachs, and Rabobank — helping marketing teams scale output without risking compliance or brand dilution.

Our tools are built for highly regulated industries, balancing flexibility for local teams with control for brand and compliance leaders.

If your teams are:

- Going through a rebrand, merger, or acquisition

- Supporting dozens of branches with limited marketing resource

- Concerned about brand integrity or compliance exposure

…it’s time to explore a solution built for financial services.

Bring order to brand complexity

Discover how banks and credit unions scale their content with Papirfly

Bring order to brand complexity

Discover how banks and credit unions scale their content with Papirfly

Discover how banks and credit unions scale their content with Papirfly

FAQs

Papirfly provides a centralized brand hub with templated content creation tools, so every branch accesses and uses the same compliant, approved assets.

Yes. Papirfly is designed for regulated industries like banking and insurance, offering governance, audit trails, and brand control.

With Papirfly, new branches or teams can quickly access the latest brand materials, helping align communications and eliminate legacy content.

Absolutely. Templates allow localization while locking down brand and legal elements to maintain compliance.

Yes. Papirfly provides dedicated onboarding and support teams to tailor the system to your institution’s needs.

Table of contents:

- How to maintain brand consistency during mergers in financial services

- Why brand compliance is critical for financial content creation

- How a DAM creates brand integrity in every financial services branch

- Regulated industries need marketing tools built for compliance

- Think of your DAM like a hotel

- How to evaluate enterprise DAM systems in 2025

- Download the enterprise-ready evaluation tool

- FAQs